3 Key Benefits of Using Practifi and Addepar

It’s a challenging time to be a wealth management firm. Loyal and long-standing employees are retiring, technology options are expanding, and regulations are tightening. As if this wasn’t enough, changing client demographics pressure firms to retain and attract younger clients who will soon inherit a majority of the world’s wealth.

Combining the best of two industry-leading platforms, Practifi’s partnership with Addepar helps firms overcome some of these challenges. Our integration makes it easier to provide exceptional services, track AUM growth trends and monitor profitability to ensure firm goals are on track.

1. Deliver exceptional services with a unified view of client data

Today, technology and operations leaders have endless options when it comes to technology for their business. While this seems attractive, too many tools can quickly result in unnecessary costs. In addition, when technology platforms don’t share data in meaningful ways, advisors and their teams waste valuable time switching between platforms to update data manually. Not only does this frustrate staff, but referencing inaccurate data can also harm client relationships. Research shows that 81% of consumers expect personalized customer service, so attempts to build a relationship could do more harm than good if data isn’t stored or used correctly.

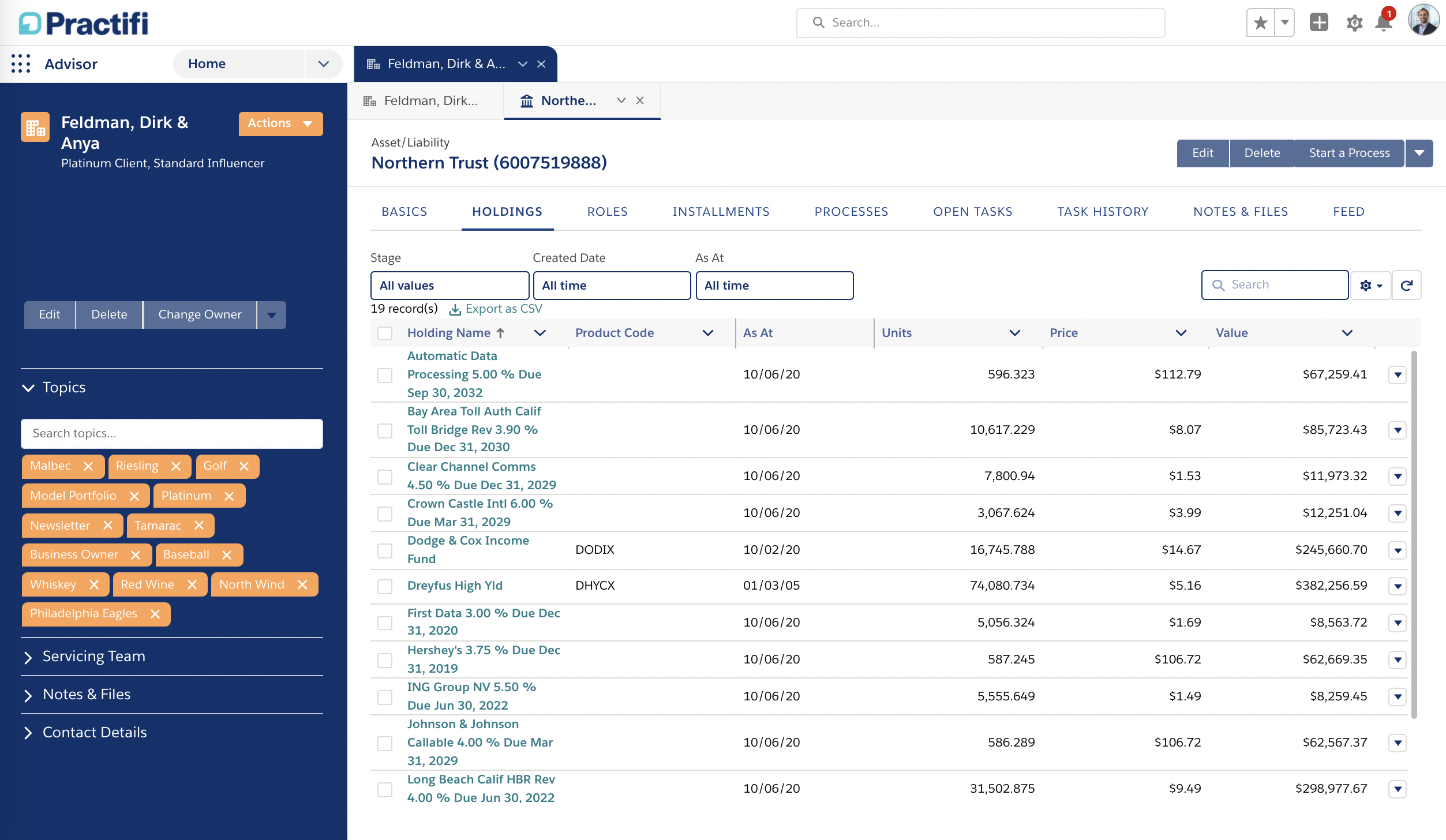

View client Asset, Liability, and Holding data within Practifi and any related active services.

Our API-based integration with Addepar ensures essential client data is shared between the two platforms to enable advisory teams to deliver exceptional services to all client demographics. Advisors can see client asset, liability and holding data from Addepar within Practifi, reducing the need to switch between platforms. In addition, client servicing staff can view which assets have related active services to ensure all tasks are assigned and on track.

2. Track AUM growth trends across the firm

The total market value of the assets under management is an important metric that signifies many things; a firm’s size, profitability, success and influence in the market – just to name a few. While each firm calculates AUM in their own way, it’s important the valuation increases over time. However, if firms lack the technology to centralize client financial data and don’t have access to the right reporting capabilities, they will struggle to track AUM metrics. As a result, firms might miss critical trends, such as slowly decreasing AUM.

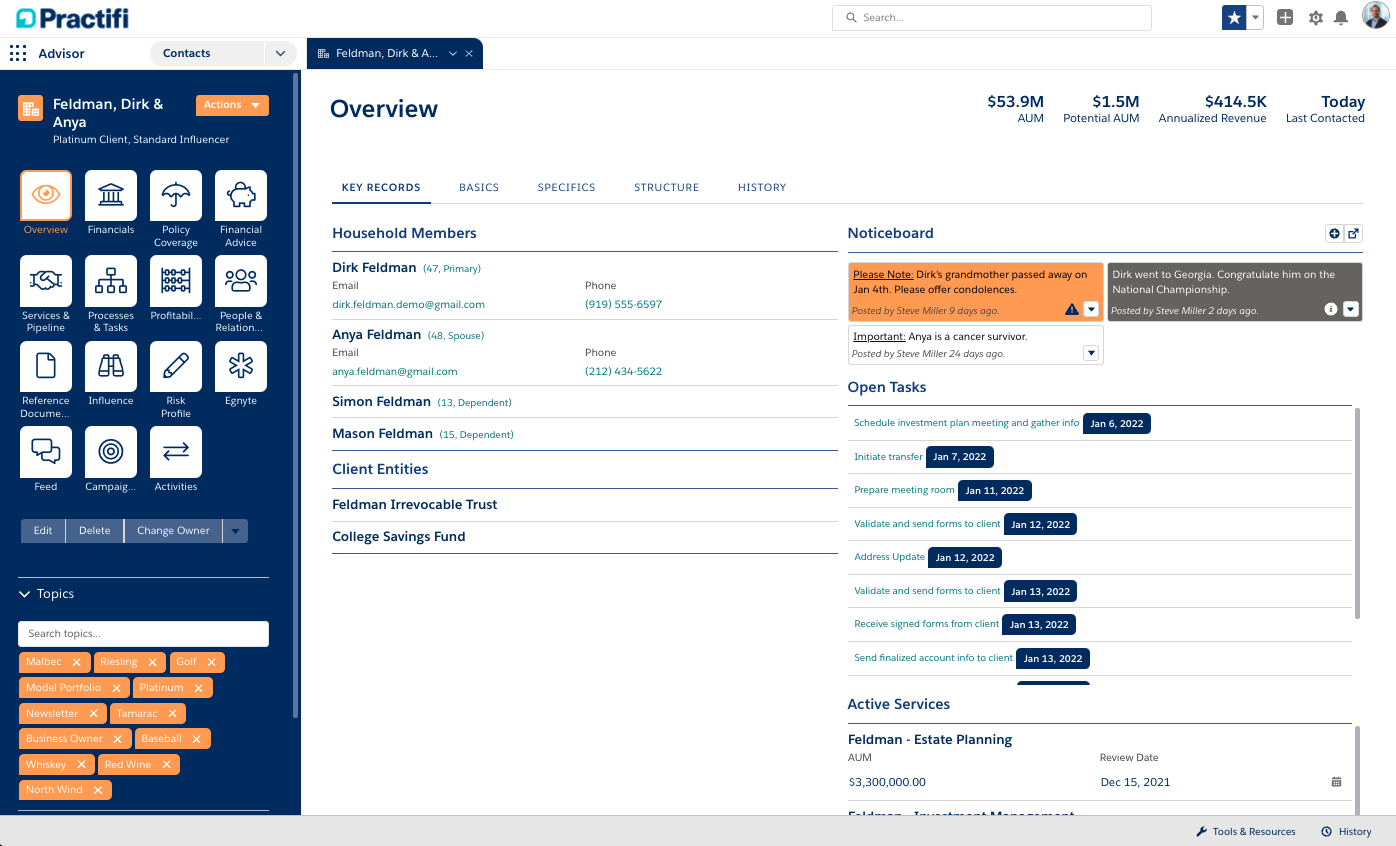

Track AUM trends from a client, advisor, division and firm perspective.

By integrating with Addepar, Practifi syncs client assets, holdings and liabilities and surfaces this information in the client overview, giving teams the most up-to-date AUM figures. In addition, with Practifi’s customizable reports, you can track AUM trends from a top-down perspective. Keep an eye on firm, division, and advisor AUM trends to ensure your business stays on track.

3. Monitor firm profitability

High-performing wealth management firms increasingly want to understand the various factors that contribute to greater profitability so they can take advantage of them. However, aligning the right metrics is difficult when important data such as logged time, hourly rates, installments and AUM are located across different platforms. As a result, many firms fail to solve the profitability puzzle.

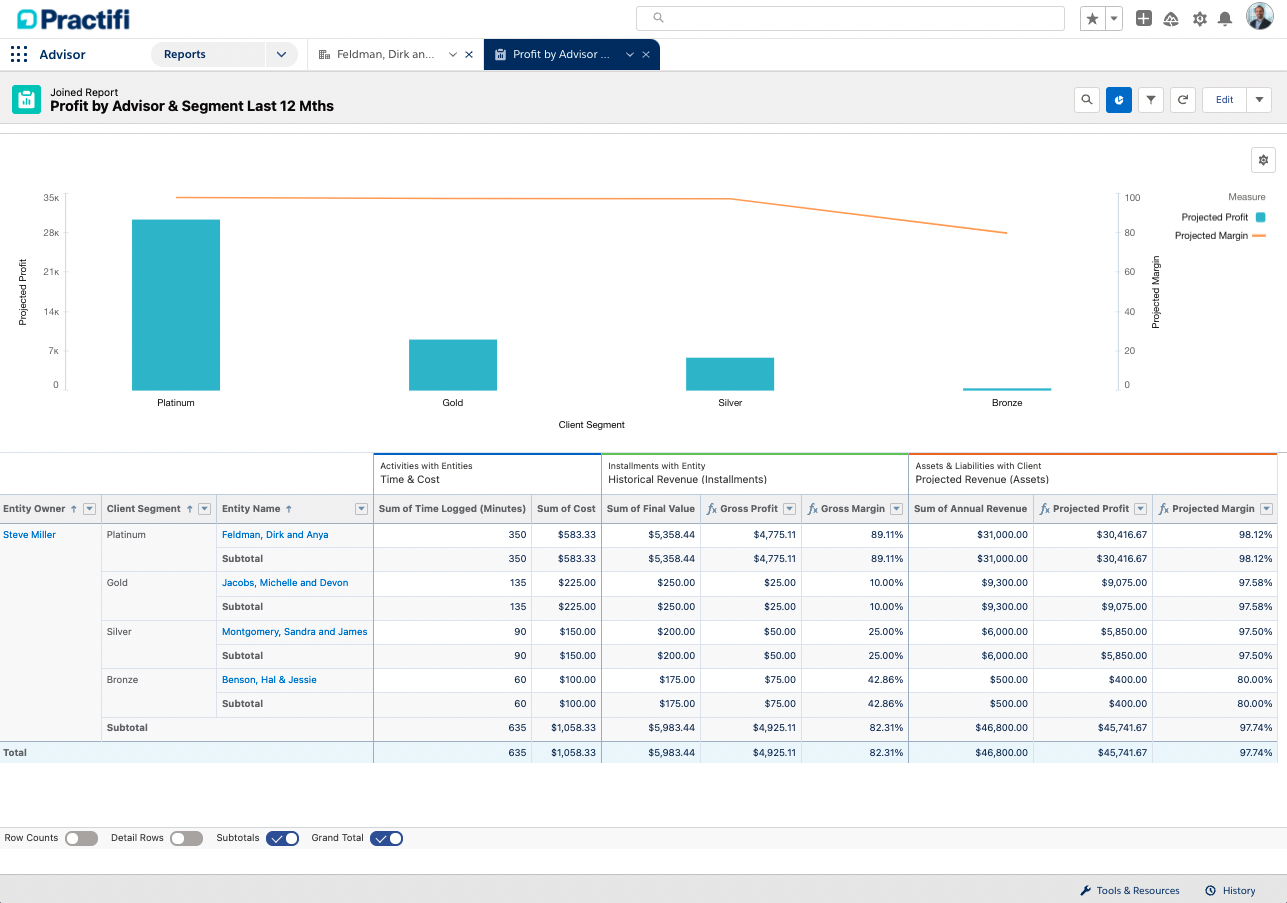

Monitor firm profitability across advisor, client and segments with the help of Asset data from Addepar.

Practifi makes it easier to monitor profitability and identify the clients, advisors and segments that move the needle for your firm. By syncing asset data from Addepar, your team can view AUM alongside logged time, hourly rates and installments to accurately calculate time and cost, historical revenue and projected revenue per client. Customizable reports and performance dashboards bring these insights to life so your team can monitor profitability trends and make informed business decisions.

Interested in learning more?

As market and client demographics continue to change, wealth management firms need to have the right platforms and data in place to monitor business trends and take action. Our integration with Addepar helps your firm overcome some of these challenges by making it easier to provide exceptional services, track AUM growth trends and monitor profitability to ensure goals are on track.

If you’re interested in learning more about our platform integrations, visit our integrations page. Alternatively, reach out to a member of our team for a demo today.