How Practifi Helps Solve the Profitability Puzzle

To withstand changing industry forces, forward-thinking wealth management firms increasingly want to understand the various factors contributing to greater profitability. However, obtaining a clear picture of firm revenue and growth is often constrained by complex legacy technology, manual processing errors and disconnected data systems that affect different roles and business functions.

As a result, firm leaders can’t track and measure the right metrics that accurately reflect the business’s financial health. Fortunately, tracking and analyzing profitability is more straightforward with the appropriate technological infrastructure in place.

Platforms like Practifi bring data across your business together to make it easier to monitor key profitability metrics. As a result, you can identify which advisors, clients and services are moving the needle for your firm. Here are a few ways Practifi helps forward-thinking firms solve the profitability puzzle.

1. Increase visibility into profitability drivers

Capturing revenue and cost data is critical for firms to track profitability trends. However, managers will struggle to fully understand firm financial health if data is siloed in separate platforms. Furthermore, if profitability drivers aren’t visible or accessible within the system, teams may doubt the validity of the data used in profitability analysis.

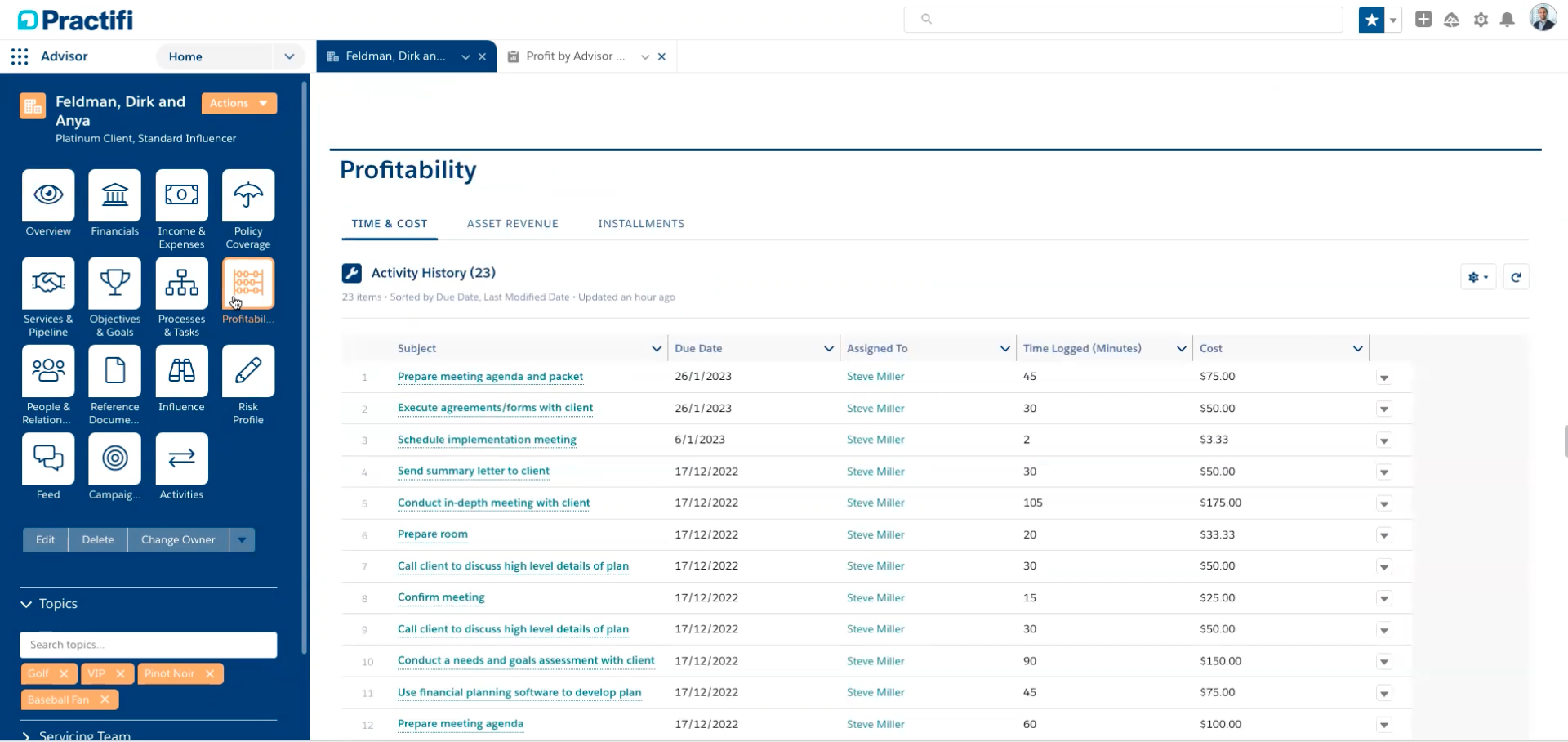

The Profitability menu on the client record consist of three separate tabs that give you an overview of billed time, serviced assets and installments.

Practifi captures and surfaces key financial information so your team can easily see what variables contribute to each client’s profitability and, as a result, the firm’s profitability. The Profitability menu on the client record provides a detailed overview of billed time, serviced assets and installments, so teams can ensure revenue and cost drivers for each client are accurate and up to date.

2. Monitor profitability trends

Measuring a firm’s current and future profitability is critical in evaluating business growth and longevity. As such, firm leaders and management must monitor profitability to identify areas of improvement and opportunities across the firm. However, when outdated systems and reporting tools fail to provide accurate insights into cost and revenue trends, firms cannot make strategic business decisions to improve financial health.

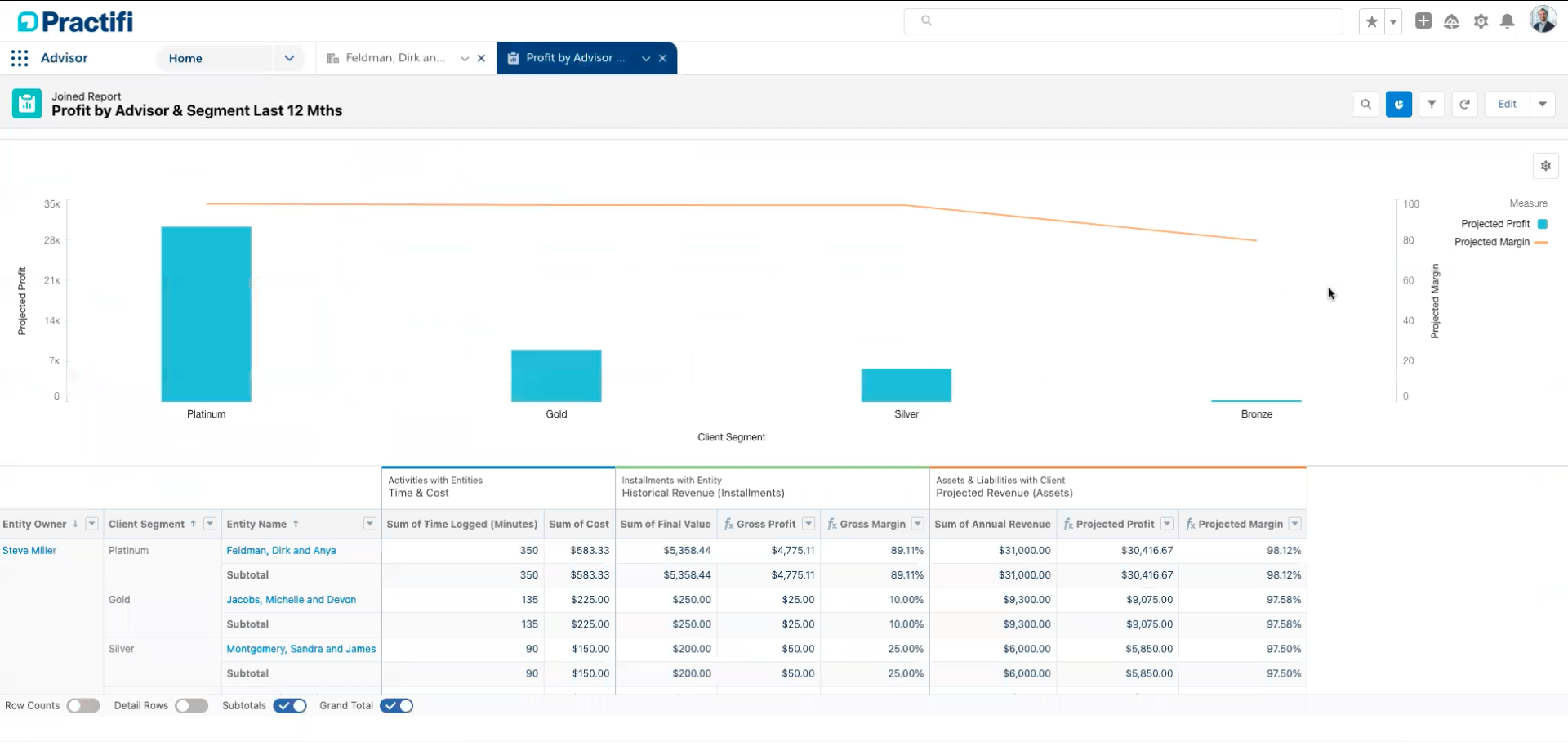

Combining cost and revenue data, firms can use pre-built profitability reports to identify trends and make more informed decisions.

Practifi’s reporting capabilities help surface and visualize data in meaningful ways so leadership teams can gain helpful insights and make more informed business decisions. Pre-built profitability reports bring key revenue and cost data together, helping leaders and managers monitor the firm’s financial health. As a result, with a more comprehensive understanding of profitability drivers, leadership teams can identify which clients, services and advisors are most (and least) profitable for the business.

3. Optimize for success

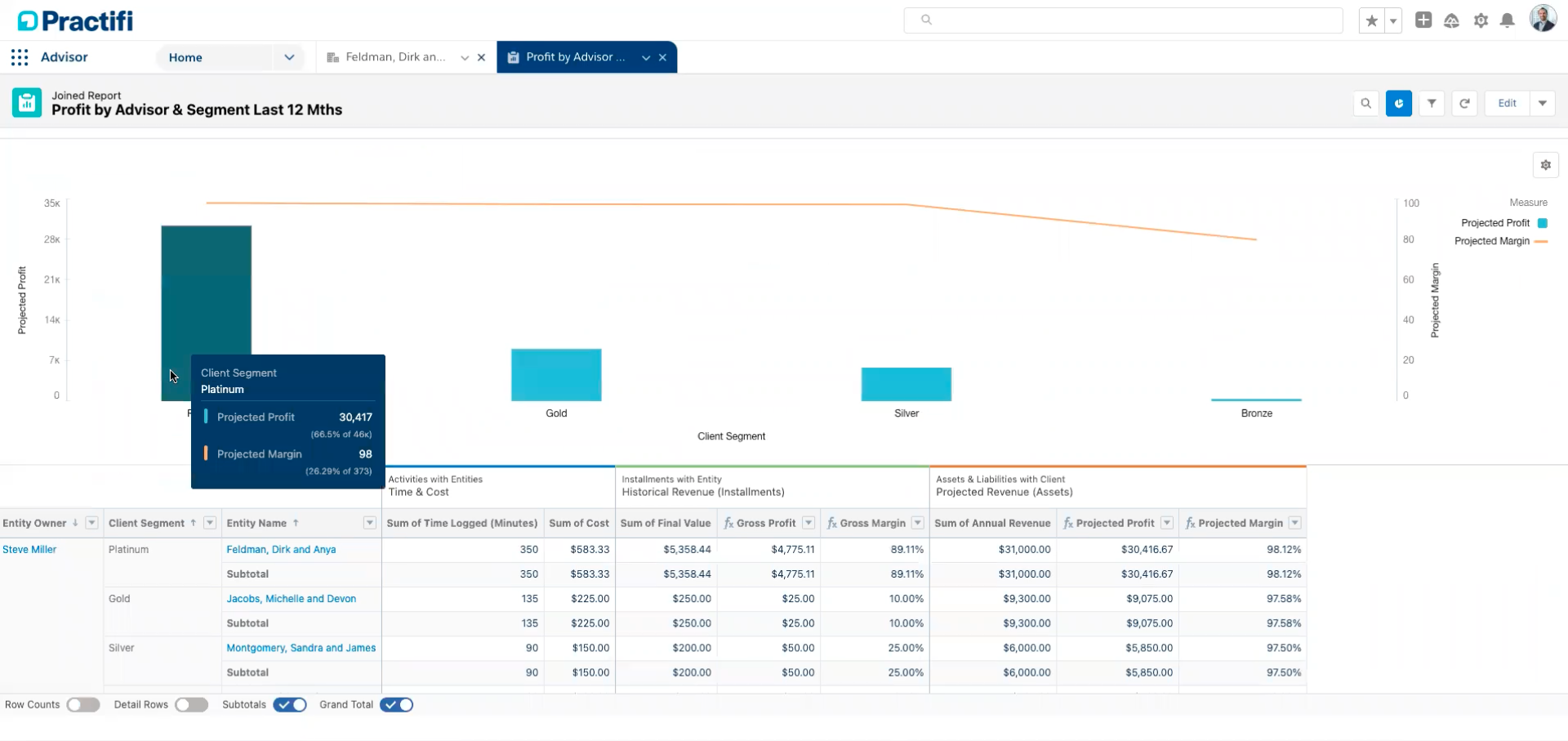

While high net-worth clients bring in attractive assets and service opportunities to the firm, they can also take up a lot of your company’s time. If firms factor in the time spent required to service high net-worth clients, they may be surprised to find the profits aren’t as high as expected. That’s why it’s crucial to identify which clients, segments and advisors are most profitable so other teams can adopt similar practices or focus more on those business areas.

Firms can easily identify which clients and segments are moving the needle with an easy-to-understand breakdown of client, segment and advisor profitbility.

Practifi enables teams to explore data across time with various filters, making it easier to identify which clients, segments and advisors generate the most revenue minus the cost and time involved. By doing so, advisors and their teams can better understand the ideal client and try to bring in similar business for the firm. In addition, advisors may consider “graduating” less-profitable and time-intensive clients out of the firm.

Demographic factors can also provide valuable insights into potential investment areas and possible revenue risks. For example, with 44% of RIA clients aged 60 or older, estate planning and wealth distribution may be on their mind. Looking at profitability by age and other demographics can help reveal insights about the durability of the firm’s current revenue stream and where action needs to be made.

Interested in learning more?

For firms to understand how their business is performing, they must adopt the right technology that tracks and measures profitability. Practifi unifies key financial data in one platform so you can gain visibility into revenue and costs drivers, monitor firm profitability and ensure your firm is optimized for success.

If you’re interested in learning more about how our profitability capabilities can help you track your firm’s financial health, reach out to a member of our team today.